05 Mar Why Your Invoices Are Worth Their Weight In Gold!

A fellow consultant tells his clients that they should staple a £20 note to each invoice so that they would not lose any. He made me laugh and his clients take it as a joke, but he’s absolutely right. This is just an example to explain how important it is to keep record of all our invoices.

Admin is the most procrastinated task in many restaurants.

Nobody wants to deal with invoices, orders, delivery notes, suppliers, etc. Chefs are great at cooking and front of house staff are great with people. However, usually most of them don’t appreciate having to do admin.

It is easy to lose invoices and delivery notes and not have all expenses correctly accounted for. Many restaurants only check their numbers once a quarter or year.

And what many restaurant owners or managers do not know is that it is very important to have a record of all our expenses in the restaurant and save each one of the invoices, or request invoices from those that are only delivery notes.

And why is every invoice worth its weight in gold?

Let’s see it with a simple example.

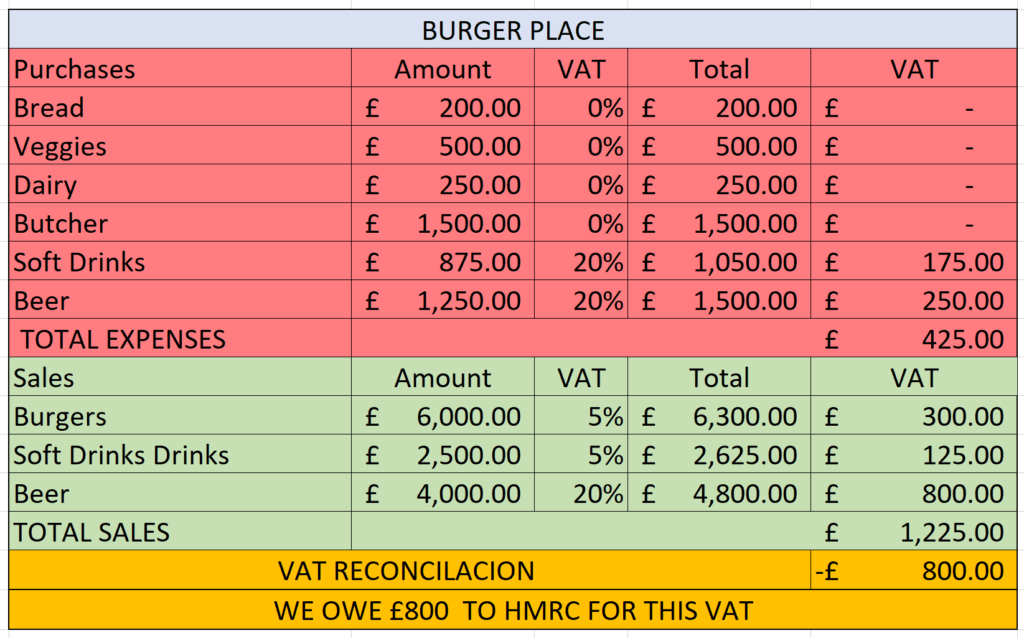

Let’s imagine we have a burger place that sells burgers, soft drinks and beer.

Now, let’s imagine that we lose the invoice for the beer. So we will not be able to justify that VAT of £250 to HMRC. Then what we would need to pay HMRC would be £1050 instead of £800.

Also since we don’t have the invoice, we won’t be able to claim it as an expense and we would also pay more Corporation Tax.

Keep Track Of Your Invoices

Remember, according to HMRC, to reclaim VAT on purchases, you must keep records to support you claim and you must also have valid VAT invoices.

So you see each invoice is precious. At Pendulo we want to make life easier for restaurant and bar managers. In the Pendulo app you can keep track of all your invoices and delivery notes, and keep a digital copy by taking a pic. You can also automatically obtain a VAT reconciliation report. So you can take it into account in your cash flow and see how much of the money you have in your bank account really belongs to the business and how much you must pay to HMRC.

It will also help you with all your important key performance indicators: cost of goods sold, gross profits, average spend per head and much more.

No Comments