25 Jun Food and soft drinks VAT rates and changes in hospitality

Food and soft drinks VAT rates and changes in hospitality

On 8 July 2020, the government announced that it would introduce a temporary 5% reduced rate of VAT for certain hospitality supplies such as food and non-alcoholic beverages sold for on-premises consumption in restaurants, cafes and pubs and hot takeaway food and non-alcoholic beverages.

This cut in the VAT rate from the standard rate of 20% took effect from 15 July 2020 to 31 March 2021. As announced in the 2021 budget, the government decided to:

- extend the temporary reduced rate of VAT of 5% until 30 September 2021

- prepare for a new rate of 12.5% from 1 October 2021 to 31 March 2022

So what is the impact of this on your menu? Let’s see it with an example.

Imagine we sell a Beef Carpaccio on our menu

Cost of the dish is £3.02

Dish prices (and therefore their margins) are affected by the VAT.

Price of the dish including VAT is £13

Net price with 5% VAT would be £13/1.05 = £12.38

Net price with 12.5% VAT would be £13/1.125 = £11.55

Net price with 20% VAT would be £13/1.20 = £10.83

Profit we make with 5% VAT per dish would be 12.38 – 3.02 = £9.36

Profit we make with 12.5% VAT per dish would be 11.55 – 3.02 = £8.53

Profit we make with 20% VAT per dish would be 10.83 – 3.02 = £7.81

So there will be a difference in our profit from the 1st of October in the sale of 1 dish of £0.83

And from 1st of April of 2022 the difference would be £1.55

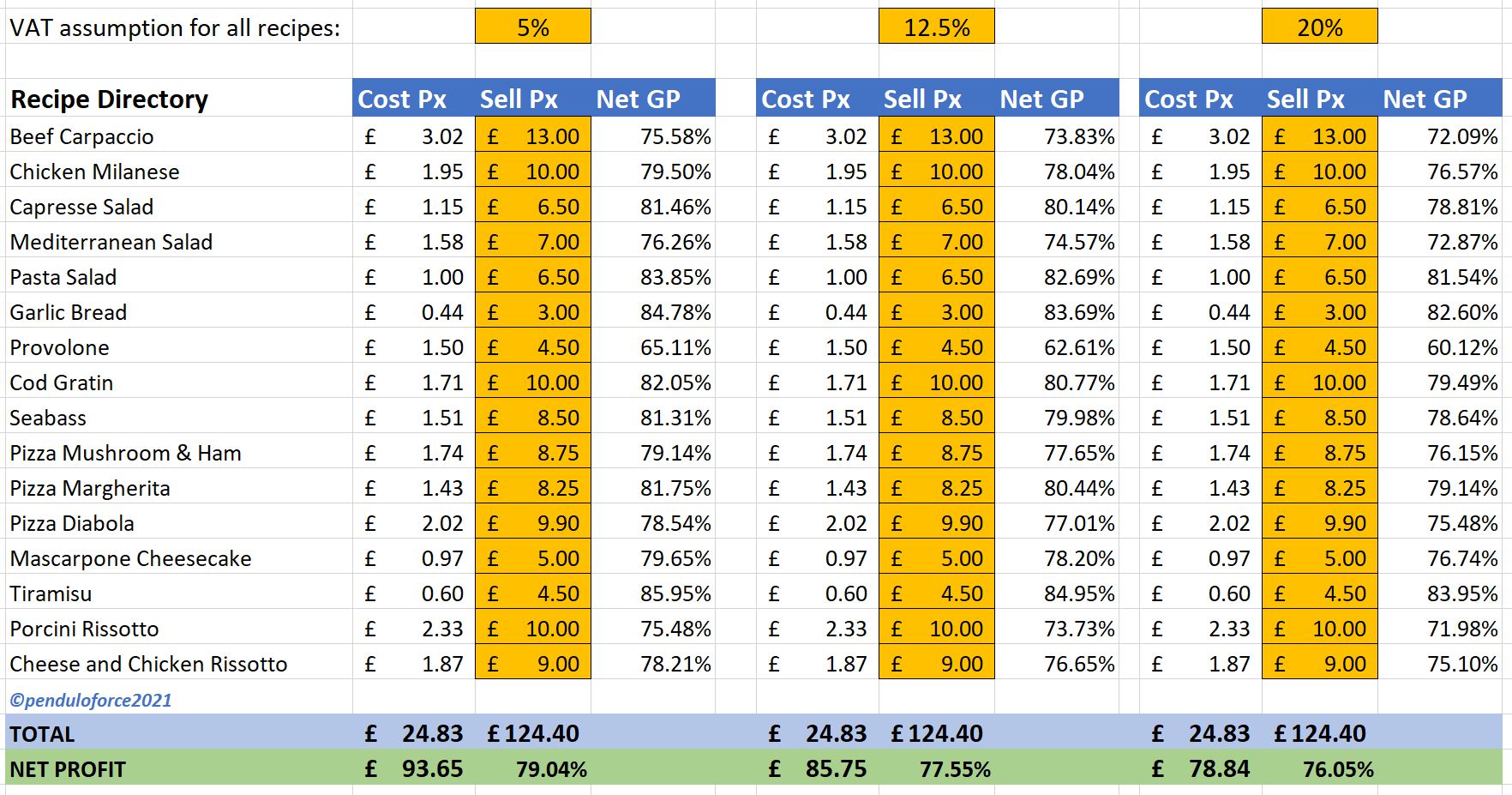

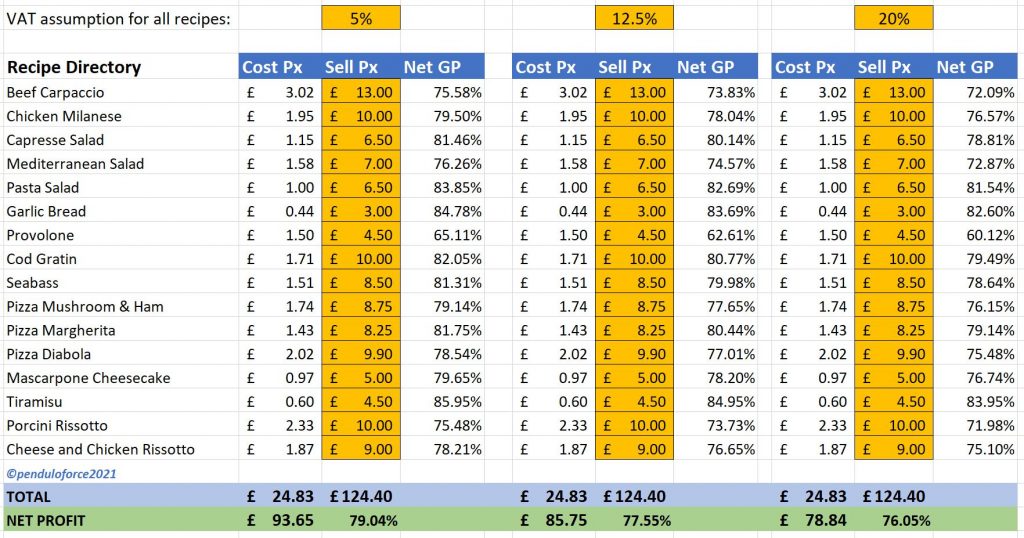

Now let’s see how it would affect the whole menu:

If this is our menu and we sell one of each dish, the gross sales would be £124.40 but our margin for 5% VAT would be £93.65, for 12.5% VAT £85.75 and for 20% VAT our profit would be £78.84

From the 1st of October, if you make £18000 in food and non-alcoholic drinks sales per week and you don’t adjust your prices, you would be making an average of 1.49% less profit. On a weekly basis that would be £268.20 less of profit with the same sales.

Of course, depending on your sales mix you would have a bigger or lower impact.

Dish prices and therefore, their margins are affected by the VAT changes, so make sure you take it into account when working on your menu engineering.

If you need some help, do not hesitate and contact us here 😊

No Comments